Your Trusted financial Services partner.

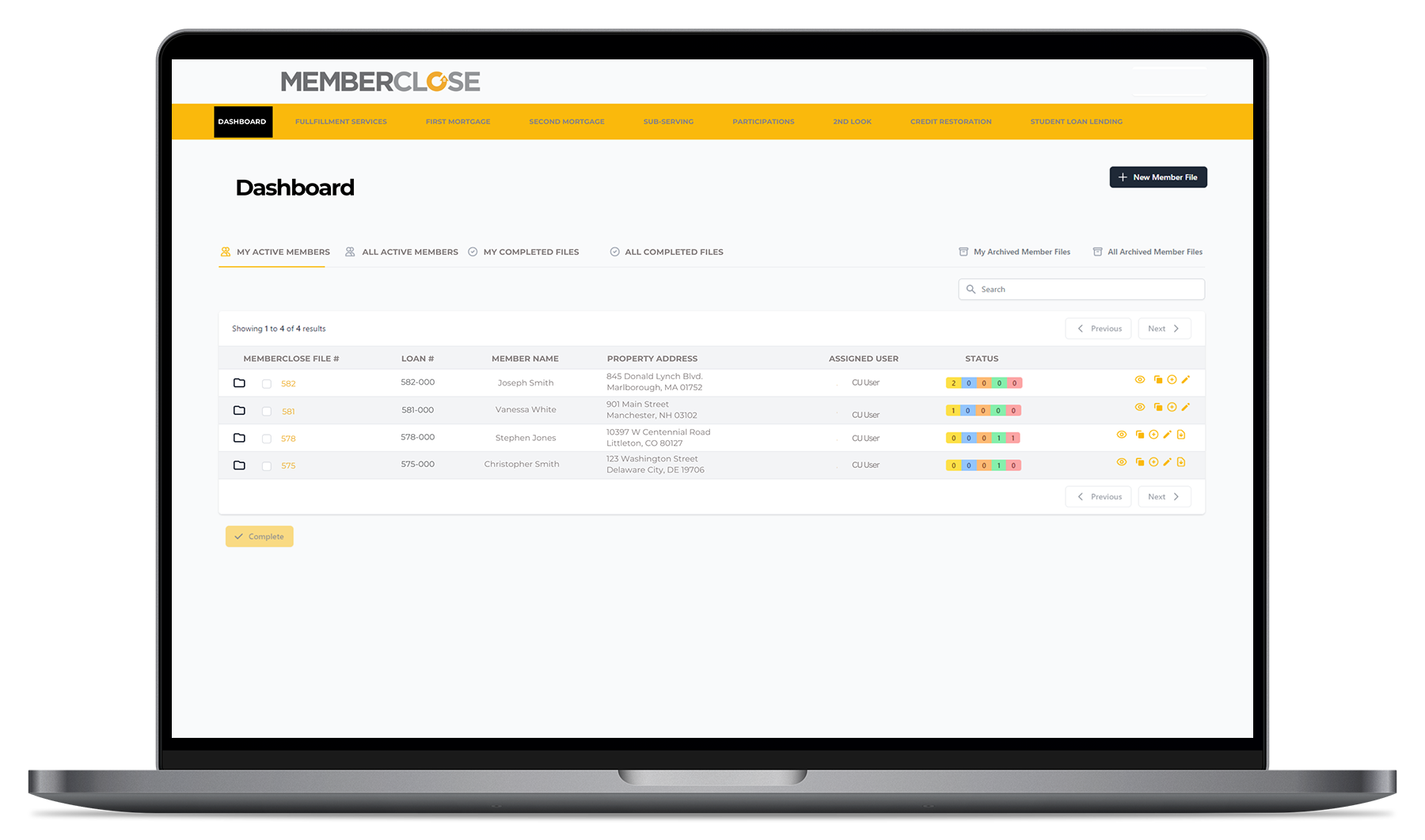

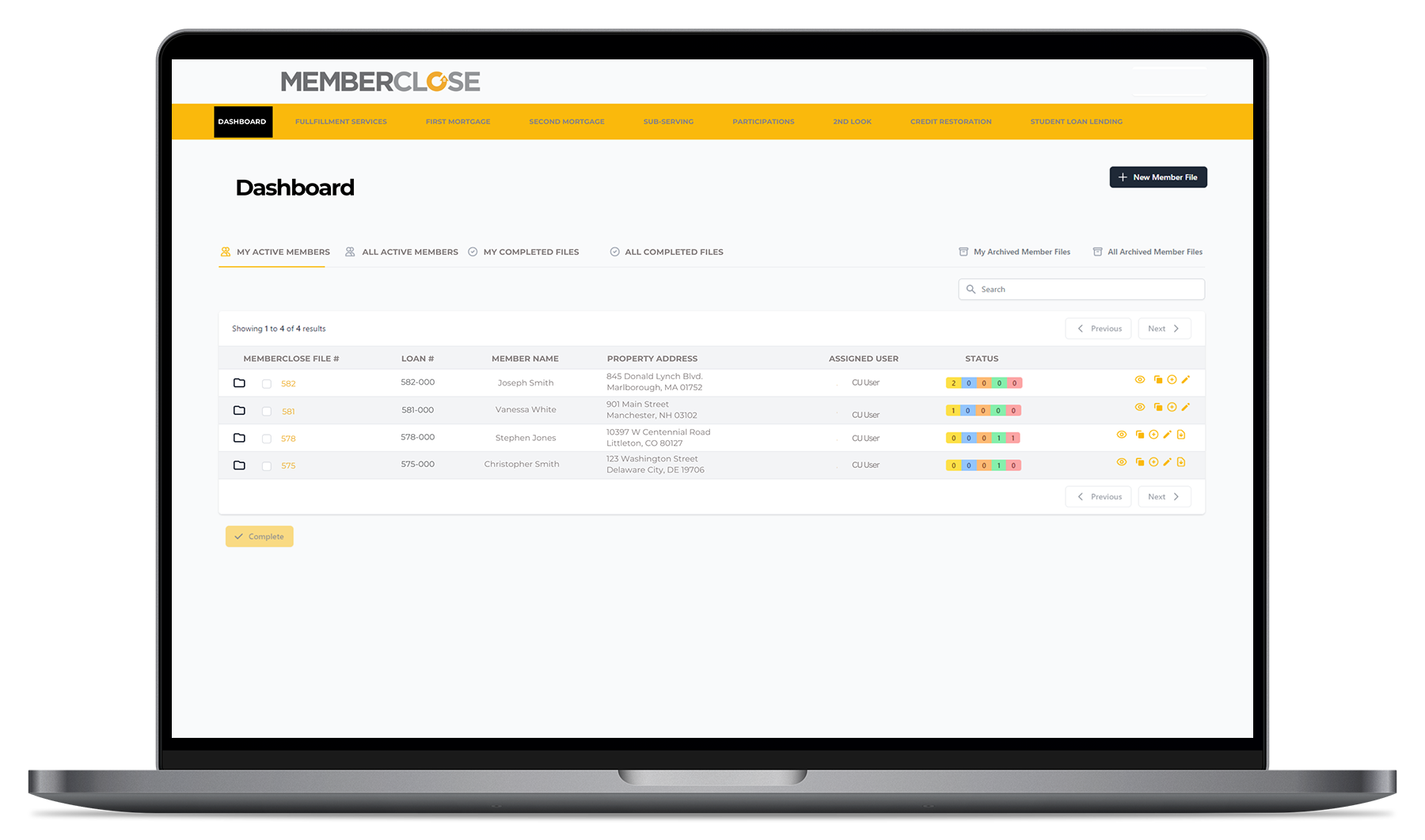

Since 2004, MemberClose has been providing a quick and seamless experience for credit unions and their members by streamlining the real estate lending process so you can close more loans, faster.

In one convenient platform, we aggregate best-in-class providers offering credit reporting, appraisals, document preparation, and more. Together, we’ll identify the needs of your credit union, allowing us to focus on serving you, so you can better serve your members.

From credit to closing, our proven all-in-one real estate lending process reduces both errors and processing time – creating a seamless experience for you and your members.

MemberClose credit union partners get exclusive access to finance services, such as: credit repair, student loan lending, commercial lending, and more. Log-in to the platform to access additional financial programs for your members.

"I have worked for LPS Employees FCU for 6 years now and we have been using MEMBERCLOSE since then. If you have an issue or problem there is always someone to help. When there are updates or changes made to the rules and regulations, the program will guide you through them to keep everything up to date. MEMBERCLOSE is a great product for the home equity loans we do here at LPS Employees FCU."

Son Nguyen, Assistant Manager / Loan Officer

"MemberClose provides our credit union with a fast and easy way to expedite the appraisal and lien process. The result is that we can close loans much faster and with less expense. That benefits both the member and the credit union."

John P. Owens, VP Sales & Lending

"Along with helping us save money on our equity loans, MemberClose provides us the added benefit of being more able to efficiently process and close our out-of-state 1st mortgage and equity loans."

Jeff Dunn, SVP of Lending